Opening Balance Impot Dynamics 365 Business Central Forum Community Forum

February 27, 2023Content

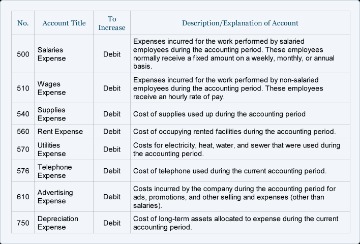

Prior to an accrual adjustment, the revenue account or the expense account is understated. All adjusting journal entries use an Income Statement and a Balance Sheet account. Adjusting entries update the accounts to their proper balances.

Temporary accounts carry a zero balance at the beginning of each accounting period. Revenue accounts will always start each new accounting period with a beginning balance of zero. Capital is shown Right Hand Side on the Ledger account and they are represented with the insertion “By” for recording all the credit side entries in a ledger. Opening balance of capital is recorded by passing an opening entry i.e., “By Balance b/d”. Assets are shown Left Hand Side on the Ledger account and they are represented with the insertion “To” for recording all the debit side entries in a ledger. Opening balance of an asset is recorded by passing an opening entry i.e., “To Balance b/d”.

Post navigation

Salary a/c, Rent a/c, Commission paid a/c etc., are a few most common examples of expense accounts. In the value of liability the particular liability account gets credited and vice-versa. Creditors a/c, Bills payable a/c, Bank loan a/c etc., are a few most common examples of liability accounts. If you are entering opening balances from statements, enter the payable opening balances as statements arrive. There is nothing wrong with using a suspense account such for opening balances, and its certainly not something that should absolutely never be done. Of course, there are more pros/cons to using this method that I wont go into.

- If you prefer to opt out, you can alternatively choose to refuse consent.

- Book value of a firm is the sum of cost values of all its assets and any total liabilities as stated in its books of accounts.

- And as Nitin said, never use a balancing account such as again.

- Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- This way, you can update opening balance in Asset and Liability accounts.

I can do my final general ledger opening, which of course should be the opening that I want to have, when I go live. Either You have forgot to add some opening balances (maybe Fixed Assets?) or for some OB the signs are wrong. Then you should also have the Receivables GL account opening balance and 1000 in the account – so all should even out.

Steps to Open a New Financial Year in an Existing OpenERP Configuration¶

The concept can also refer to the initial entries made at the beginning of an accounting period. An opening entry is the initial entry used to record the transactions occurring at the start of an organization. The contents of the opening entry typically include the initial funding for the firm, as well as any initial debts incurred and assets acquired.

However, as far as accounting concepts go, this is pretty simple and straightforward. Besides, being easy to understand and use, it’s crucial for the financial what is opening entry wellbeing of your business. Understanding what resources and what things you have to pay back is the basis of making good business decisions.

Opening balance and Debitoor

Are your balances in your general ledger other than correct? My first thought is your AR, AP and Banks are wrong. Using online homework help services is not equivalent to cheating. Our services are intended to support students with their homework and provide them with the resources they need to succeed academically. With the help of our online homework help services, students can receive immediate assistance with their homework from any location, at any time.

- It would be in your best interest to complete these entries within the first month after your Go Live Date.

- Besides, being easy to understand and use, it’s crucial for the financial wellbeing of your business.

- It saves you time, money and keep the related debit with its credit in a single journal.

- The transfers are done to know about value of trading in a proper way, and Profit or Loss is determined.

- Closing entries deal primarily with the balances of real accounts.

It is very important for a transaction report to have an equal value of the debit part as well as credit part. When an error occurs, then unequal debit and credit amount indicates that there is an error. So, it becomes important to rectify these values to make a proper adjustment. If the journal accounting entry amount doesn’t match your bank account statement and you close it out, then the software will adjust the opening balance equity account balance. For a free trial of accounting software, click here.

Ideally, yes, your opening balance equity should be at zero. If it is not, this means an unbalanced or unaccounted-for entry in your balance sheet needs to be looked at closer. Owner’s equity is the proportion of company assets that the business owners can claim.

The opening balance of an account can be found on the credit or debit side of the ledger account. When the opening balance is shown on the debit side then it is said to have a debit balance and when the opening balance is shown on the credit side then it is said to have a credit balance. E record some transactions which are inter-connected and take place simultaneously by means of a compound journal entry. For example, we record the receipt of cash from a debtor and allowance of discount to him through a single journal entry.

The debit or credit balance of a ledger account brought forward from the old accounting period to the new accounting period is called opening balance. This will be the first entry in a ledger account at the beginning of an accounting period. In other words, the closing balance of your previous accounting period will become the opening balance for the new accounting period. After that, the journal entry is called an opening journal entry. Because all assets have a debit balance, so these are debited in an opening journal entry and all liabilities have a credit balance, hence these are credited in an opening journal entry.

What is opening and closing entry?

Essentially, all opening entries of a new fiscal year are the exact entries and figures of the previous period's closing entries. Therefore, the beginning balance of these accounts can be taken from the previous period closing account balances.

What is meant by the opening entry?

Opening entry is referred to as the first entry that is recorded or which is brought forward from a previous accounting period to the new accounting period. In an ongoing business, the closing balance of the previous accounting period serves as an opening balance for the current accounting period.